Covid-19’s impact on M&A and private equity in Southeast Asia

taken from: https://www.consultancy.asia/news/3340/covid-19s-impact-on-ma-and-private-equity-in-southeast-asia

Consultancy.asia

Global management consultancy L.E.K. Consulting has surveyed more than 100 dealmakers – investment bankers, M&A consultants and private equity investors – in Southeast Asia to gain insight in how the Covid-19 pandemic is impacting the sentiment of buyers and sellers. A roundup of the main findings.

Deal flow has decreased substantially in the region since the pandemic outbreak primarily due to sellers being unwilling to bring assets to the market and buyers being concerned about the outlook.

A lack of available financing amid more lending and investment scrutiny by banks and investors hinders around a quarter of deals currently in process.

In private equity, nearly two-thirds of the deals backed by financial investors agreed upon earlier this year (prior to Covid-19) but not yet closed are currently being renegotiated.

Deals in the healthcare sector are notably less impacted by Covid-19, not surprising given the surge in demand for healthcare products and services amid the Covid-19 virus. Deal flow in the retail and industrial sectors have been affected the most.

In terms of short term economic recovery, the surveyed dealmakers forecast that the pandemic will peak in Q3 or Q4 2020, with deal volumes returning in the end of 2020 and continuing in 2021.

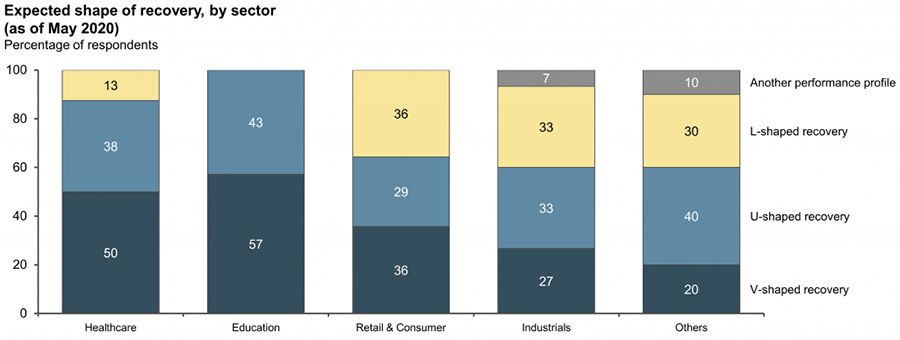

In terms of mid to long term economic recovery, sentiment differs by sector. In consumer and Industrials sectors, nearly one-third of respondents believe that the downturn will be sustained in the coming years in the form of an L-shaped recovery.

In the more recovery prone healthcare and education sectors, deal activity is expected to see a V-shaped recovery.

Portfolio company growth expectations of private equity firms have been lowered across all sectors for 2020 and the next three-five years. Healthcare is an exception, where medium-term growth outlook has been raised in the portfolios.

This downward pressure on revenue growth, combined with reduced profitability and higher risks, is leading to lower expectations for enterprise valuation multiples. These have been toned down by about 3x EBITDA tums since the start of the Covid-19 outbreak.

About L.E.K. Consulting’s survey

The survey was completed in June 2020 and completed by dealmakers in India, the Philippines, Thailand, Vietnam, Indonesia, Malaysia and Singapore.